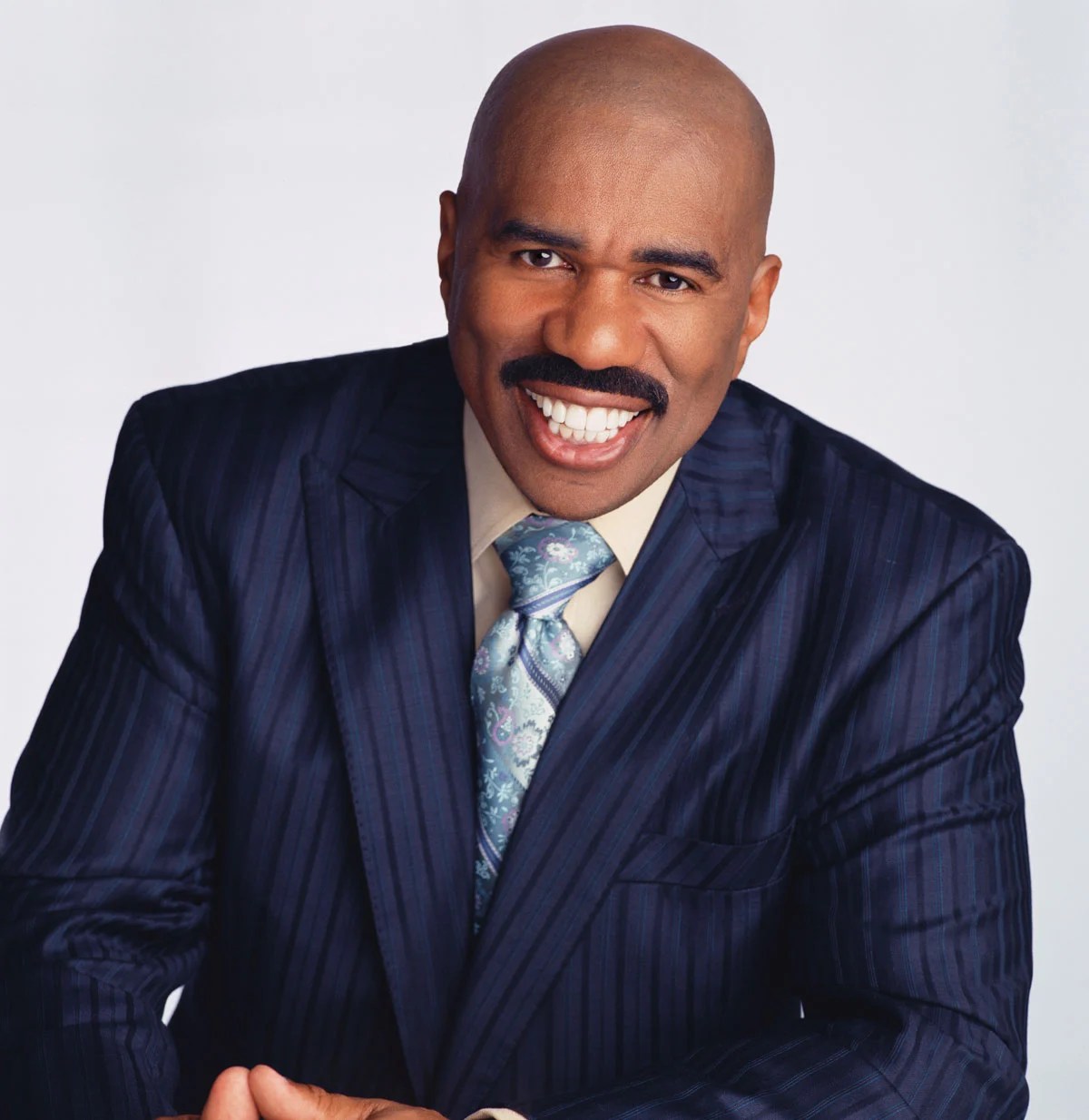

Steve Harvey tax debt refers to a highly publicized case involving the American television personality and comedian Steve Harvey and the Internal Revenue Service (IRS). In 2008, it was reported that Harvey owed the IRS over $20 million in unpaid taxes and penalties.

The case highlights the importance of tax compliance and the consequences of failing to pay taxes. It also raised questions about the financial management practices of high-profile celebrities.

Harvey's tax debt was eventually resolved through a payment plan with the IRS. The case serves as a reminder that even those with substantial wealth can face financial difficulties if they do not properly manage their tax obligations.

Steve Harvey Tax Debt

Steve Harvey's tax debt case highlights several key aspects related to tax compliance, financial management, and the consequences of failing to pay taxes. Here are eight key aspects to consider:

- Tax Evasion: The intentional failure to pay taxes.

- Tax Avoidance: Legitimate methods to reduce tax liability.

- IRS Audit: Examination of tax returns by the IRS.

- Tax Lien: Legal claim against property to secure unpaid taxes.

- Wage Garnishment: Withholding of wages to satisfy tax debt.

- Tax Amnesty: Programs that allow delinquent taxpayers to settle their debts.

- Celebrity Finances: The unique financial challenges faced by high-profile celebrities.

- Financial Responsibility: The importance of managing finances responsibly to avoid tax problems.

These aspects are interconnected and highlight the complexities of tax compliance. Harvey's case serves as an example of the consequences of failing to meet tax obligations and the importance of seeking professional advice to navigate tax laws and regulations.

Tax Evasion

Tax evasion, the intentional failure to pay taxes, is a serious offense with significant consequences. In the case of Steve Harvey, his tax evasion resulted in a substantial debt to the IRS and damaged his reputation.

- Hiding Income: Tax evaders may conceal income from the IRS to reduce their tax liability. Harvey reportedly failed to report some of his income, leading to an understatement of his tax liability.

- False Deductions: Claiming false or inflated deductions is another common tax evasion tactic. Harvey may have claimed excessive deductions to lower his taxable income.

- Offshore Accounts: Hiding assets and income in offshore accounts is a more sophisticated form of tax evasion. Harvey has not been accused of this, but it is a tactic used by some wealthy individuals to avoid paying taxes.

- Frivolous Tax Arguments: Some tax evaders use frivolous arguments to avoid paying taxes. These arguments are often based on misinterpretations of the tax code or conspiracy theories.

The consequences of tax evasion can be severe. In addition to owing back taxes and penalties, tax evaders may face criminal prosecution. Harvey's case highlights the importance of complying with tax laws and the risks associated with tax evasion.

Tax Avoidance

Tax avoidance refers to legal strategies used to reduce tax liability without breaking any laws. While Steve Harvey's tax debt case involved allegations of tax evasion, it also highlighted the importance of understanding tax avoidance strategies to optimize financial planning.

- Deductions and Exemptions: Taxpayers can reduce their taxable income by claiming eligible deductions and exemptions. Harvey may have missed opportunities to maximize these deductions, resulting in a higher tax liability.

- Retirement Savings: Contributions to retirement accounts, such as 401(k)s and IRAs, can lower current tax liability and grow tax-deferred. Harvey's retirement planning strategies could have potentially reduced his tax burden.

- Charitable Giving: Donations to qualified charities can provide tax deductions. Harvey's charitable contributions may have offered tax savings, depending on the timing and amount of his donations.

- Business Expenses: Legitimate business expenses can be deducted from business income to reduce tax liability. Harvey's business expenses, such as travel and entertainment costs, could have been optimized to minimize his tax burden.

Understanding tax avoidance strategies is crucial for effective financial planning. While Harvey's case involved tax evasion, it serves as a reminder to explore legitimate methods to reduce tax liability within the boundaries of the law.

IRS Audit

An IRS audit involves a thorough examination of tax returns by the Internal Revenue Service (IRS) to ensure accuracy and compliance with tax laws. Steve Harvey's tax debt case highlights the importance of understanding the audit process and its potential consequences.

- Audit Selection: The IRS selects tax returns for audit based on various factors, including income level, deductions claimed, and prior audit history. Harvey's high income and complex financial situation may have increased his chances of being audited.

- Audit Process: During an audit, the IRS will request documentation to support the information reported on the tax return. Harvey's auditors likely scrutinized his income sources, expenses, and deductions.

- Audit Findings: The audit process may result in adjustments to the taxpayer's tax liability. In Harvey's case, the audit revealed unpaid taxes and penalties, leading to his substantial tax debt.

- Audit Resolution: Taxpayers can agree with the audit findings or contest them through an appeals process. Harvey may have negotiated a payment plan with the IRS to resolve his tax debt.

Understanding the IRS audit process is critical for taxpayers to ensure compliance and avoid potential tax liabilities. Harvey's case serves as a reminder of the importance of accurate record-keeping, professional tax advice, and timely resolution of any tax disputes.

Tax Lien

In relation to "steve harvey tax debt", a tax lien is a legal claim against property by the government to secure payment of unpaid taxes. When Steve Harvey failed to pay his substantial tax debt, the IRS filed a tax lien against his property as a means to collect the outstanding amount.

- Filing of Tax Lien: The IRS typically files a tax lien after assessing a tax liability and sending notices to the taxpayer. Harvey likely received multiple notices before the lien was filed.

- Notice to Public: A tax lien serves as public notice that the government has a claim against the property. Potential buyers or lenders are alerted to the outstanding tax debt, which can affect the value and marketability of the property.

- Property Seizure: In extreme cases, the government can seize and sell the property to satisfy the tax debt. Harvey faced the risk of losing his property if he failed to resolve his tax debt.

- Lien Removal: A tax lien can be removed once the underlying tax debt is paid in full, along with any penalties and interest. Harvey's tax debt was eventually resolved through a payment plan, resulting in the removal of the lien.

Understanding the implications of a tax lien is crucial for taxpayers facing tax debts. Steve Harvey's case highlights the severe consequences of unpaid taxes and the importance of seeking professional advice to navigate tax obligations and resolve tax liens effectively.

Wage Garnishment

Wage garnishment is a legal procedure that allows the government to withhold a portion of an individual's wages to satisfy an outstanding tax debt. In the case of "steve harvey tax debt," the IRS could have potentially initiated wage garnishment proceedings to collect the unpaid taxes.

- Legal Authority: The IRS has the legal authority to garnish wages if a taxpayer fails to pay their tax debt. This authority is granted by the Internal Revenue Code, which outlines the procedures for wage garnishment.

- Notice and Hearing: Before garnishing wages, the IRS is required to provide the taxpayer with written notice and an opportunity for a hearing. Harvey would have received notice of the garnishment and had the chance to contest it.

- Amount Garnished: The amount of wages garnished is typically limited to a certain percentage of the taxpayer's disposable income. The IRS considers factors such as the taxpayer's financial situation and dependents when determining the garnishment amount.

- Impact on Taxpayer: Wage garnishment can have a significant impact on a taxpayer's financial situation. Reduced wages can make it difficult to meet living expenses, pay other debts, and save for the future.

In Steve Harvey's case, wage garnishment could have been a potential consequence of his unpaid tax debt. However, it is unclear whether the IRS actually initiated garnishment proceedings against him. Regardless, the threat of wage garnishment highlights the importance of complying with tax obligations and resolving tax debts promptly to avoid severe financial consequences.

Tax Amnesty

Tax amnesty programs are designed to provide delinquent taxpayers with an opportunity to settle their unpaid tax debts without facing criminal prosecution or other severe penalties. These programs typically involve a reduced payment amount or a streamlined process for resolving tax liabilities. In the case of "steve harvey tax debt," tax amnesty could have been a potential option to help him resolve his substantial tax debt.

Tax amnesty programs can be beneficial for taxpayers who have failed to pay their taxes due to various reasons, such as financial hardship, lack of understanding of tax laws, or extenuating circumstances. By participating in an amnesty program, taxpayers can avoid the accumulation of additional penalties and interest, as well as the risk of enforced collection actions, such as wage garnishment or property seizure.

However, it is important to note that tax amnesty programs are not universally available and may have specific eligibility criteria and deadlines. Additionally, participation in an amnesty program may not fully absolve a taxpayer from all tax liabilities and penalties. Therefore, it is crucial for taxpayers to carefully consider the terms and conditions of any amnesty program before making a decision.

Celebrity Finances

The financial challenges faced by celebrities can be vastly different from those faced by the general public. High-profile celebrities, such as Steve Harvey, often have complex financial situations that can make it difficult to manage their tax obligations effectively.

One of the unique challenges faced by celebrities is the high level of scrutiny they are under. Their financial decisions are often publicized, which can make it difficult to make mistakes without facing public criticism. This can lead to celebrities making financial decisions based on fear of negative publicity rather than sound financial planning.

Another challenge faced by celebrities is the pressure to maintain a certain lifestyle. Celebrities are often expected to live in luxurious homes, drive expensive cars, and wear designer clothes. This can lead to celebrities spending beyond their means in order to keep up with the expectations of their fans and the media.

In Steve Harvey's case, his tax debt may have been a result of poor financial planning and a lack of understanding of his tax obligations. He may have also been under pressure to maintain a certain lifestyle, which could have led him to make poor financial decisions.

The case of Steve Harvey highlights the importance of celebrities having a strong understanding of their financial situation and seeking professional advice to help them manage their tax obligations. By understanding the unique challenges faced by celebrities, we can better understand the factors that may have contributed to Steve Harvey's tax debt and avoid similar issues in the future.

Financial Responsibility

Financial responsibility is a crucial aspect of managing personal finances effectively and avoiding potential tax issues. The case of "steve harvey tax debt" highlights the significance of financial responsibility and its direct connection to tax-related problems.

Steve Harvey's tax debt reportedly stemmed from a lack of proper financial planning and failure to pay taxes promptly. This indicates a lack of financial responsibility, which can lead to severe consequences, including substantial tax debts, penalties, and legal issues.

To avoid such problems, it is essential to practice financial responsibility by:

- Creating and adhering to a budget to track income and expenses effectively.

- Prioritizing essential expenses and managing discretionary spending wisely.

- Understanding tax obligations and setting aside funds for tax payments throughout the year.

- Seeking professional financial advice when needed to make informed decisions.

- Maintaining accurate financial records and receipts for tax purposes.

By practicing financial responsibility, individuals can proactively manage their finances, avoid overspending, and fulfill their tax obligations promptly. This not only prevents potential tax debts but also promotes financial stability and peace of mind.

FAQs on Steve Harvey's Tax Debt

The case of Steve Harvey's tax debt has raised several questions and concerns. Here are answers to some frequently asked questions on this topic:

Question 1: What is Steve Harvey's tax debt, and how did it occur?

Steve Harvey reportedly owed the Internal Revenue Service (IRS) over $20 million in unpaid taxes and penalties. The exact reasons for his tax debt are not publicly known, but it has been suggested that it may be related to poor financial planning and a lack of proper tax advice.

Question 2: What are the consequences of Steve Harvey's tax debt?

Steve Harvey's tax debt has resulted in significant financial and reputational damage. He has been forced to pay back the taxes he owed, along with penalties and interest. Additionally, his tax debt has become a subject of public scrutiny and criticism.

Question 3: What can we learn from Steve Harvey's tax debt?

Steve Harvey's tax debt serves as a cautionary tale about the importance of responsible financial management and tax compliance. It highlights the need for individuals, especially high-profile celebrities, to seek professional financial and tax advice to avoid similar issues.

Question 4: What is the status of Steve Harvey's tax debt?

Steve Harvey's tax debt has been resolved through a payment plan with the IRS. He has reportedly paid back the majority of what he owed.

Question 5: What are the potential legal implications of Steve Harvey's tax debt?

Failure to pay taxes can have legal consequences, including criminal charges. However, it is unclear whether Steve Harvey will face any criminal charges related to his tax debt.

Question 6: What are the ethical considerations surrounding Steve Harvey's tax debt?

Some people believe that Steve Harvey's tax debt raises ethical concerns, as it suggests that he may have intentionally avoided paying his fair share of taxes. Others argue that his tax debt is a private matter and should not be subject to public scrutiny.

Summary: Steve Harvey's tax debt is a complex issue with multiple facets. It highlights the importance of financial responsibility, tax compliance, and the potential consequences of failing to meet tax obligations.

Transition: This concludes the frequently asked questions on Steve Harvey's tax debt. For further information and analysis, please refer to the comprehensive article provided below.

Tips to Avoid Tax Debt

The case of "steve harvey tax debt" highlights the importance of responsible financial management and tax compliance. Here are some tips to help you avoid finding yourself in a similar situation:

Tip 1: Create and follow a budget: A budget will help you track your income and expenses, so you can ensure that you are setting aside enough money to pay your taxes.

Tip 2: Pay your taxes on time: Don't wait until the last minute to pay your taxes. If you can't afford to pay your taxes in full, you can request an extension or set up a payment plan with the IRS.

Tip 3: Get professional tax advice: If you're not sure how to file your taxes correctly, or if you have a complex financial situation, it's a good idea to get professional tax advice. A tax advisor can help you understand your tax obligations and make sure that you're paying the correct amount of taxes.

Tip 4: Keep good records: Keep all of your tax-related documents in a safe place. This will make it easier to file your taxes and prove your income and expenses if you're ever audited by the IRS.

Tip 5: Be aware of tax scams: There are many scams that target taxpayers. Be aware of these scams and don't fall for them.

Summary: By following these tips, you can help avoid tax debt and ensure that you are meeting your tax obligations.

Transition: For more information on tax debt and how to avoid it, please refer to the comprehensive article provided below.

Conclusion on Steve Harvey's Tax Debt

The case of "steve harvey tax debt" has been a cautionary tale about the importance of responsible financial management and tax compliance. Steve Harvey's substantial tax debt highlights the severe consequences that can result from failing to meet tax obligations. It also raises questions about the financial management practices of high-profile celebrities.

The key takeaways from Steve Harvey's tax debt are as follows:

- Individuals, especially high-profile celebrities, should seek professional financial and tax advice to avoid similar issues.

- Financial responsibility is crucial for managing personal finances effectively and avoiding potential tax problems.

- Failure to pay taxes can have significant financial and reputational consequences.

- Tax compliance is essential for upholding the integrity of the tax system and ensuring that everyone pays their fair share of taxes.

Steve Harvey's tax debt has served as a reminder of the importance of financial responsibility and tax compliance. By understanding the factors that contributed to his tax debt, we can take steps to avoid similar issues in the future.

Manny Mua's Height: Unlocking Secrets And Unveiling Impact

Uncover The Secrets: Meghan Fahy's Height, Weight, And Body Confidence

Unveiling The Secrets Of Clinton Kelly's Net Worth: Surprising Revelations

Steve Harvey Net Worth 2021 The Event Chronicle

86 Steve Harvey What Makes a Man in Today's World

ncG1vNJzZmionKS7tbvSa2WapaNoe6W1xqKrmqSfmLKiutKpmJydo2OwsLmOrKuerpVitaK%2B1Z6wZqyRrXqlscGtZaGsnaE%3D